Tuition is obscenely expensive and has only been rising, with the average annual cost of tuition and fees of a four-year program at an in-state public university reaching $25,487, according to the Education Data Initiative.

So how do families prepare for this massive hit to their bank accounts? One option is a 529 plan.

What Is a 529 Plan?

Clearly, families need to save for their kids’ higher education expenses, and a 529 savings plan can be a smart choice for doing that.

These plans work much like Roth IRAs, which use tax advantages as an incentive to get people to save, and to save more. And as with a Roth IRA, if you use a 529 correctly, you won’t be slapped with federal taxes on your investment earnings when you withdraw money from the plan.

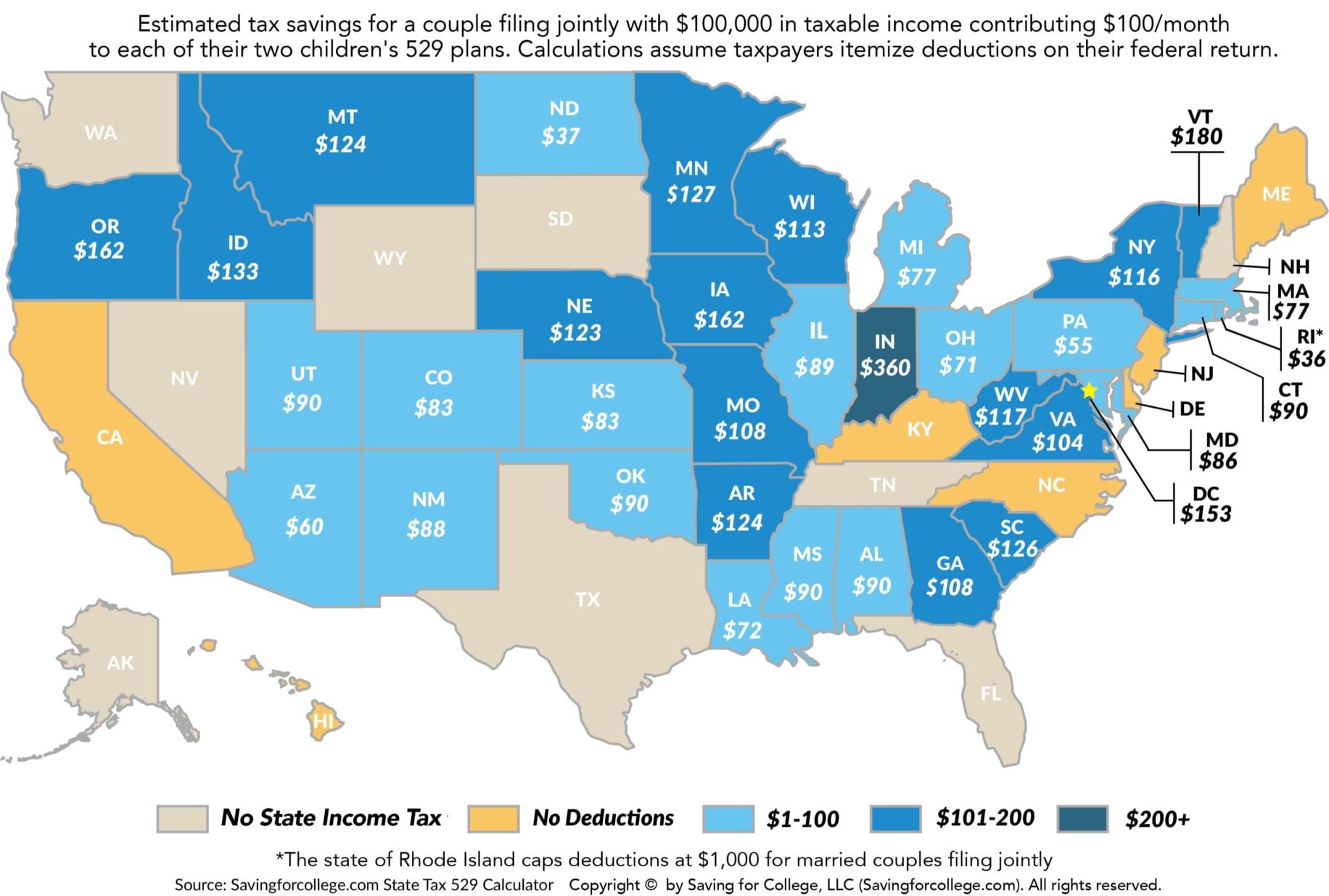

Some states provide an income tax deduction or a tax credit as an incentive for contributions. However, a state credit or deduction would be applicable only to state residents or those with income in the state. And because the credits aren’t transferable, you can’t use a credit or deduction from another state in your state.

As a result of the Tax Cuts and Jobs Act, you are also allowed to use your 529 plan to pay for your child’s private-school tuition for elementary and high school, though there is a $10,000 annual contribution limit.

How Do 529 Plans Work?

The plans are offered by the states, state agencies, or individual and group institutions. As with a Roth IRA, you can invest your after-tax dollars in a 529 plan and watch your money grow until it’s time to withdraw it, tax-free for qualified education expenses.

You can spend the money on expenses like tuition, room and board, textbooks, and even computers. Plus, you can use the money in the plan for undergraduate or graduate schools, technical or trade schools, and even some accredited schools overseas.

Not all 50 states run 529 education savings plans, but some offer 529 prepaid tuition programs as an alternative. A 529 education savings plan allows an account owner to open a savings account to help cover the cost of schooling.

A 529 prepaid tuition program, on the other hand, allows you to purchase units or credits at participating schools prior to the beneficiary attending that school.

Do All 529 Plans Offer Tax Breaks to State Residents?

You will get a tax break on your state income taxes if you open an in-state or local plan in 34 states plus the District of Columbia.

For example, New York’s 529 College Savings Program allows state residents to deduct up to $5,000 (single) or $10,000 (married filing jointly) on their state income taxes. Bear in mind, you can generally use your tax deduction or credit only in your own state, as they are not transferable.

There are, however, six states that do allow for deductions made to other states’ plans. It is your state of residence that determines what you get to do, so you should find out the rules for your own state.

But keep in mind that it isn’t all about tax breaks. Size up every state’s plan. Each offers a unique mix of benefits, incentives, and fees. Plans are easy to open. You can do so directly online with the state government or through a liaison like a financial advisor. Check out the following graphic from Saving for College to see which category your state falls into.

Who Can Open a 529 Account?

Anybody can open a 529 account. Parents and grandparents typically hold the bulk of them, but other relatives and friends can participate. They just need to be U.S. citizens or resident aliens.

How Do You Open a 529 Account?

Many state plans don’t charge account-opening fees, but most require that you either pay a lump-sum opening minimum or else make systematic contributions. That said, the minimum contribution can be quite low — typically $25 or less.

After opening an account, the first thing to do is assign a beneficiary, which can be a child or an adult. You can even designate yourself!

Next, you need to sort out how the money will be invested and used, whether that be in an individual fund portfolio, through a static option — meaning that your investment options will not change over time — or a dynamic age-based option that changes your asset allocation based on the age of the beneficiary and the remaining time until they will need to access those funds.

Is There a Cap on Annual and Lifetime Contributions?

Unlike IRAs, there are no annual contribution limits for 529 plans. But each state does impose lifetime caps ranging from $235,000 to $529,000. These caps reflect the expected cost of the average beneficiary’s higher-education expenses.

A 529 plan is designed exclusively to help a family amass college savings.

You can front-load your account with large contributions. If you’re so fortunate, you can contribute (or “gift”) up to $15,000 without triggering federal gift taxes. In total, you can contribute up to $75,000 (single) or $150,000 (married) in just one year. The gift is treated as if it were made over a five-year period. Grandparents often employ this estate-tax planning strategy.

The Bottom Line

To save for college quickly, you can’t beat a 529 plan. You get tax breaks from the federal government, as well as (in many cases) your state. Keep in mind that some 529 plans charge an annual fee based on the amount you have invested, and that fee should be taken into consideration.

One last thing: Should you ever decide to end the plan early and cash out, you’ll be hit with a 10 percent IRS penalty if you try to use the proceeds for nonqualified expenses. That said, this penalty is imposed only on the earnings portion of your plan, and it doesn’t affect your initial contributions.

Still, make sure to do your homework to find the best, lowest-cost plan that works for you and your family.

Source: Centsai, Accessed 8/1/22

This article’s view is the author’s and does not reflect the opinion of any member of CentSai’s management. The author is not being paid by any financial services company nor has been paid to promote any individual product or service. The author is not a financial advisor or a broker-dealer. The content above is education-only and any reader is encouraged to seek advice from a registered financial advisor before taking any action.

Back